DSS Difference

The Denver Street School is a faith-based, private, secondary school serving the Metro Denver, inner-city community. Located in Lakewood, we’re a beacon of hope for struggling students who’ve been unable to find their place in traditional high schools. More than just an educational institution, it’s a place where they can discover the love of Jesus and find motivation to build a better future for themselves.

Find Hope Through the

Denver Street School

95%

of DSS graduates go on to higher education, vocational school, apprenticeships, military, or the workforce within two years of graduation.

95%

graduation rate, based on eligible seniors.

10:1

student/teacher ratio.

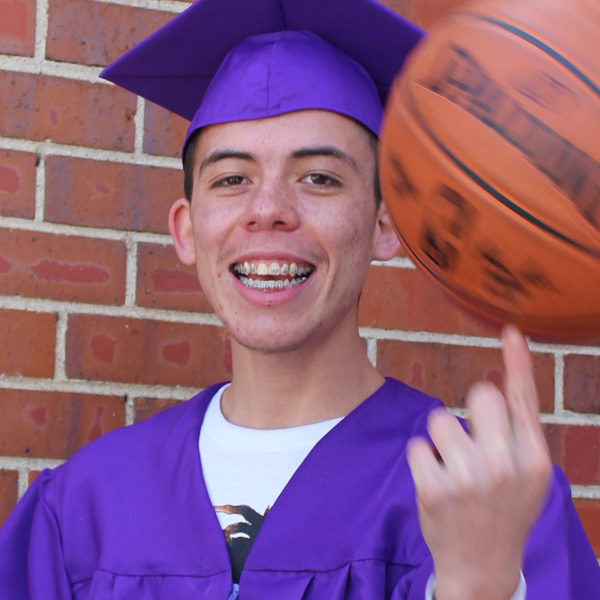

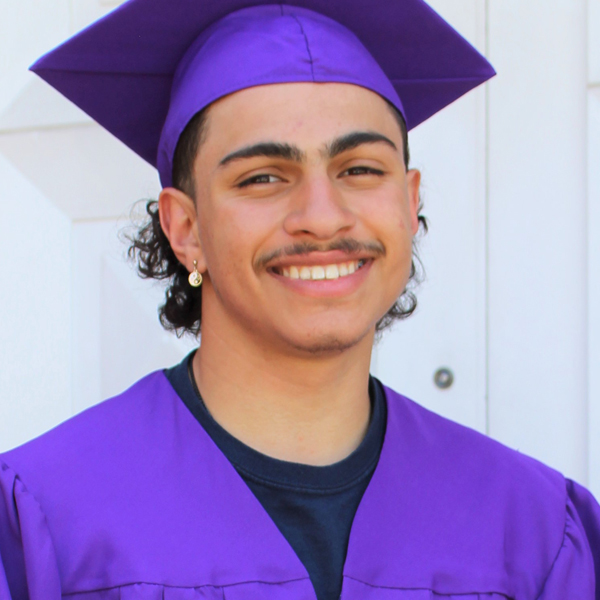

Student Life

As a struggling student, it’s often difficult to find hope and success. Everything can feel overwhelming. But with the right environment and support, you can take the next step with confidence. You can find hope for the future and feel encouraged to confront any challenge life throws at you. The Denver Street School is here to help.

Subscribe

Sign up to get ministry updates, event details, student stories, and other relevant information via email!

Become a Partner

We’re passionate about partnering with individuals, organizations, and churches who share our commitment of supporting God’s work in our communities. Together, we can make a difference by bringing hope to struggling students who need a second chance to earn their diploma and find confidence to embrace a better future. You’re invited to join us in the Lord’s mission and become a part of something bigger than ourselves.